Investing can be intimidating at any age. Ask yourself these questions to minimize intimidation:

- Will I have enough?

- Can I support my current lifestyle with what I will have?

- What do I do if the markets correct?

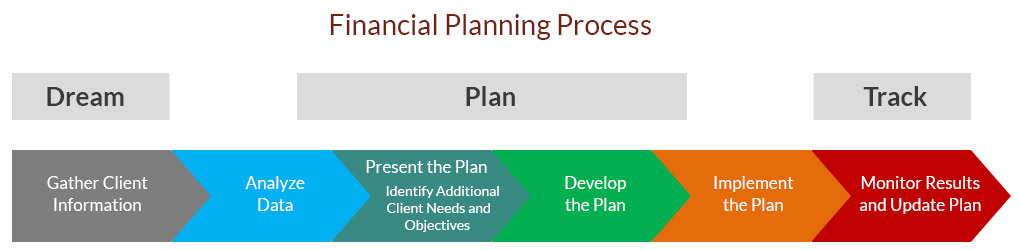

Haven Wealth Group’s team constructs a detailed financial plan that meets the client desires.

Gather Client Information

The planning process begins with the client gathering personal and financial information. Haven Wealth Group reviews the goals and priorities verbally with the client.

To make this process easier, Haven Wealth Group has constructed a financial survey.

Analyze Data

A member of the Haven Wealth Group team organizes and inputs the data into EMoney, financial planning software, for a thorough analysis. This program generates projected cash flows that consider sources of income, expenses, and asset growth over time.

Haven Wealth Group prepares a summary of all data input and assumptions per client’s goals.

Present the Plan – Identify Additional Client Needs and Objectives

The Haven Wealth Group team meets in-person with the client to review findings, discuss the plan and make recommendations to achieve client’s short and long term goals.

Develop the Plan

Nearly all financial plans leave clients with additional options to consider moving forward. The most common options to consider are increasing retirement saving contributions, decreasing debt, setting a retirement date and Social Security. Haven Wealth Group advisors are available to suggest and discuss options. Referrals to our local strategic partners can help with short and long-term goals.

Implement the Plan

Together Haven Wealth Group advisors and the client develop a set of options to implement. We can help the client stay organized by supplying a list of actionable items and assisting them in completing those tasks.

Monitor Results and Update Plan

Financial plans can be updated annually to incorporate changing circumstances. Many clients incorporate an updated financial plan with their annual investment reviews to ensure they are on track.