Key Takeaways

- Monetary policy is becoming less accommodative as the Fed looks to bring inflation down

- We are not in a recession, unemployment is low at 3.6%, GDP is predicted to grow, earnings growth projections are in line with historical trends

- History tells us there is a good probability the bottom is in for equities, following the first quarter correction.

- Equities are expected to remain range bound until the Fed stops tightening.

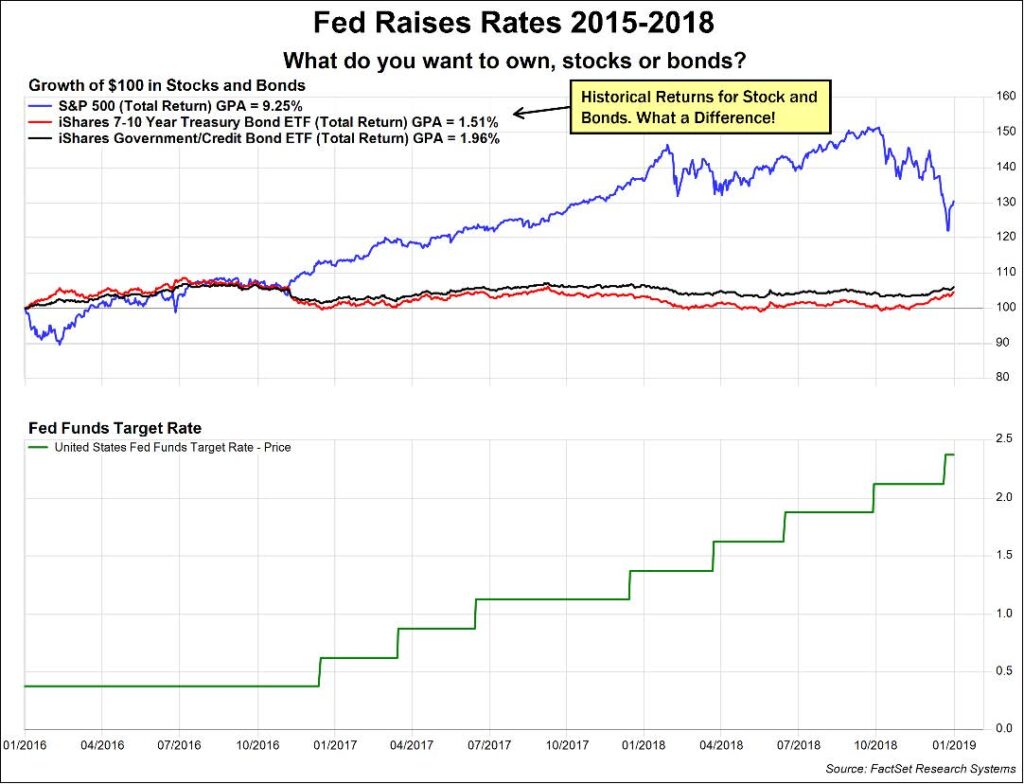

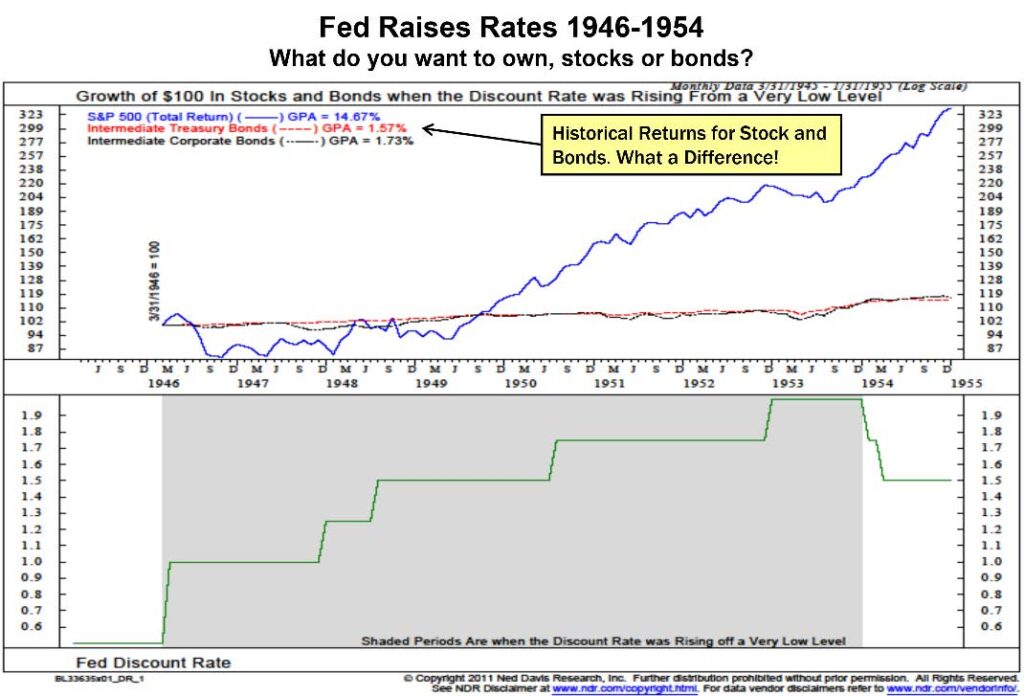

- Fixed income is expected to materially underperform equities as interest rates rise.

Turbulent Financial Markets

Equity and bond returns were negative in the first quarter of 2022. During the first quarter, the S&P500 index declined – 4.9%, while the Nasdaq declined -9.1%.

Many of our clients measure their portfolio performance from their all-time highs. For those who do, consider that the S&P500 corrected 15% from the highs, while the Nasdaq corrected 22% from the highs. The Nasdaq is dominated by growth oriented technology stocks, which took an especially hard beating. Growth stocks (i.e. Microsoft, Google, Amazon, Facebook, Nvidia) lagged value stocks (i.e. Exxon, Chevron, Consolidated Edison, Caterpillar) since mid to late November. This year value stocks had one of the best starts since the dotcom bubble burst, but Growth has rebounded since mid-March. Although Growth Stocks are volatile, since the 2008 financial crisis, large cap growth stocks outperformed large cap value stocks 85% of the time, or 11 out of 13 years.

Is the Economy recession bound?

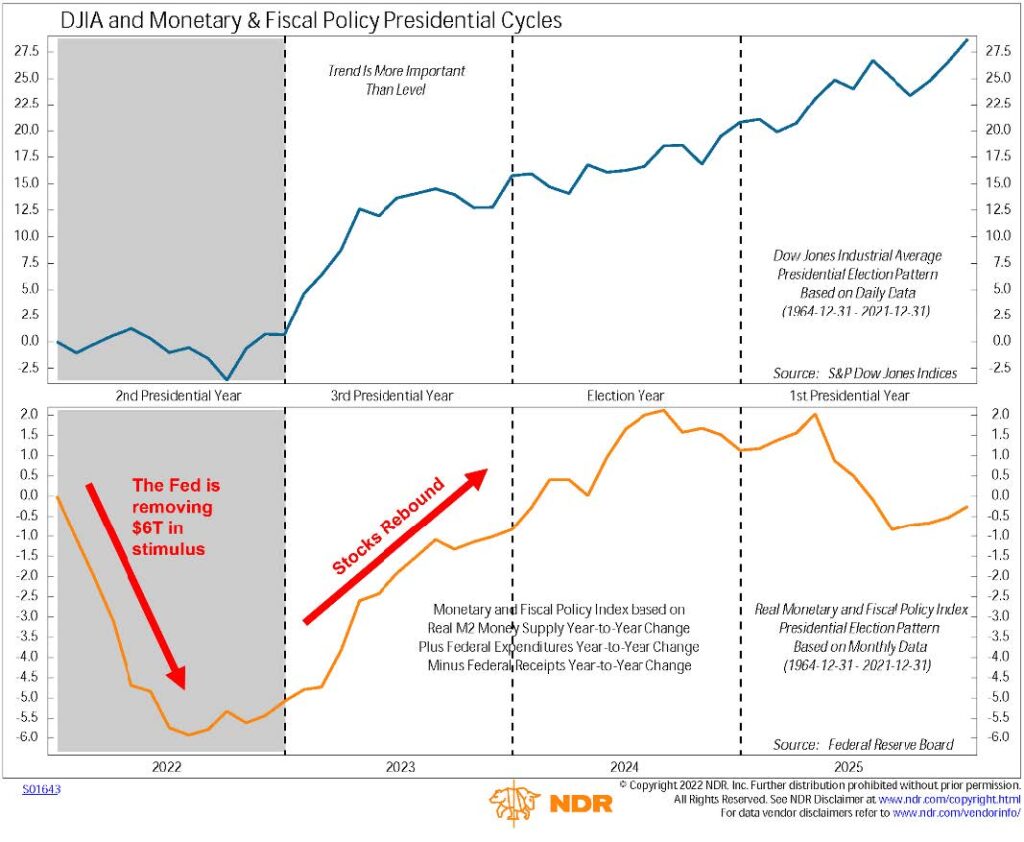

The US economy is strong. The US unemployment rate is currently 3.6%, and projections for US GDP growth are 3.5% for 2022 and 2.4% for 2023. So, what is the problem? Monetary and fiscal policy are both becoming more restrictive. During 2020 and 2021 Congress passed almost $6 trillion in fiscal spending, handing it out to both individuals and businesses in response to the coronavirus. The fiscal stimulus is ending, while the Fed is beginning an aggressive tightening cycle.

Many clients have called and suggested that they believe the US economy is headed for recession. The bond market does not agree. The yield curve is flattening (i.e. short-term rates are rising faster than long-term rates), reflecting an easing of inflationary concerns over the long term, combined with aggressive Fed tightening in the short term.

How high will interest rates go?

The Fed achieved its goal of getting back to full employment. The task at hand today is to rein in inflation. The number of Americans who rate inflation as the top issue facing the country is at the highest level in 40 years, according to a Gallup poll. Inflation is running at a 6.9% annual rate, as measured by the CPI (i.e., Consumer Price Index).

The Fed raised the Fed Funds Rate 0.25% in March and signaled another 0.50% move is coming in May. The Fed’s Summary of Economic Projections forecasts the Fed Funds rate to rise to at least 1.875% in 2022 and end 2023 at 2.75%. Interest rates are expected to hold steady in 2024. This is a much faster pace of tightening than officials projected in December, when most Fed officials penciled in three to four 0.25% basis point increases in 2022. In addition, the Fed signaled that they will soon announce and implement a plan to shrink its $9 trillion asset portfolio. In short, monetary policy is becoming less accommodative.

Why not invest in bonds?

We believe bonds will underperform stocks in 2022. With interest rates still close to historic lows, coupon rates on bonds are not high enough to compensate for price declines caused by rising interest rates.

We are utilizing Dividend Paying Stocks in place of Fixed Income. Attached are historical return analyses for both stocks and bonds during periods when short term interest rates were at or near 0% and the Fed implemented a tightening cycle. As shown, stocks clearly outperform bonds.

What is our market outlook?

The good news is that we believe the worst of the volatility is behind us, given that the S&P500 and Nasdaq already experienced substantial corrections. We believe equities will trade in a range until the Fed nears the end of the tightening cycle. In this environment, dividend paying stocks may be a great place to hide for conservative investors. Keep in mind that many stocks sport dividend yields materially higher than yields on bonds. Since mid-March, the growth stocks have started to regain leadership, thereby narrowing losses since November. This may represent an attractive entry point for aggressive investors, as many of these stocks are still -10% to -30% off their recent highs.

The upcoming mid-term elections are also positive for stocks during the second half of 2022. Stocks typically decline the first half of mid-term election years. The primary reason is that the government tends to remove stimulus during midterm election years. This year is no exception. Under almost all political scenarios, the stock market has rallied in the second half of mid-term years. As the clouds around midterm elections lift, investors may feel more comfortable allocating assets to stocks.

2022 Investment Strategy

Haven will continue to maintain balanced equity portfolios which are characterized by reduced exposure to growth and increased exposure to stable, large cap, dividend paying stocks and defensive sectors including utilities, energy, and health care.

We are advising clients to be patient and expect a choppy remainder of the year while the Fed unwinds the accommodative monetary policy put in place as a response to the pandemic.