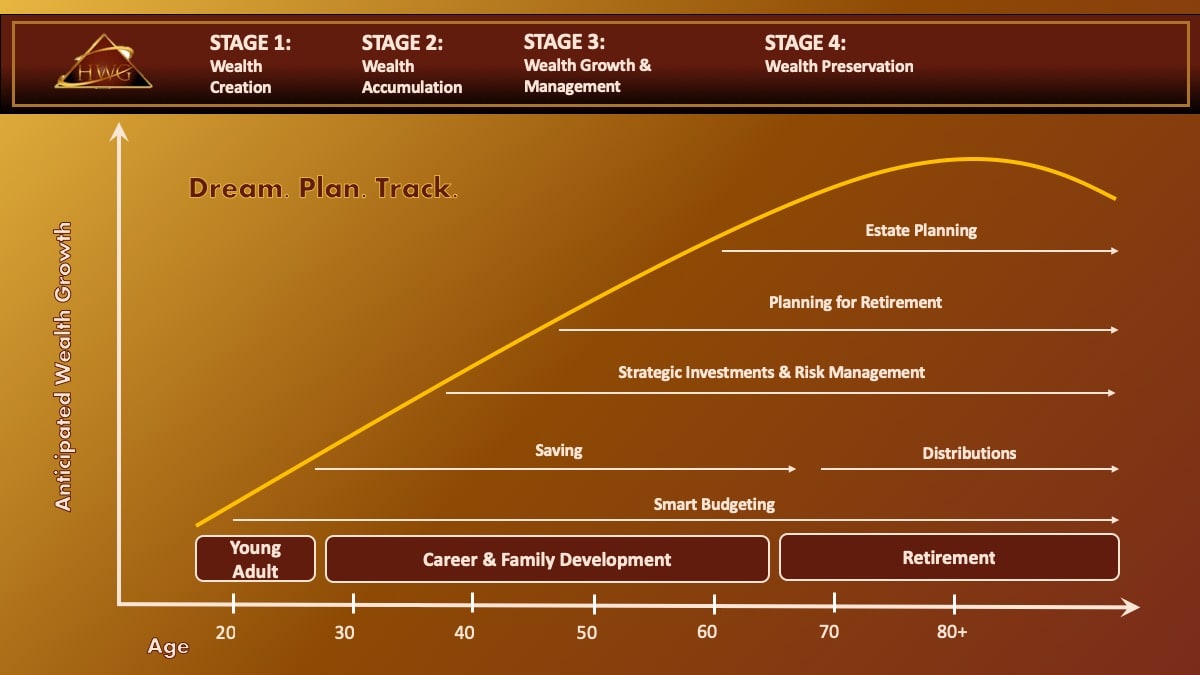

As we go through life, we all reach new milestones. Planning ahead financially is very important in reaching our life

goals. Investing can be intimidating, but financial planning can add context to your investment decisions. At Haven

Wealth Group, we believe financial planning can add great value to securing your financial future.

Stage 1: Wealth Creation

In your 20’s you may find yourself launching a career, managing various debts – from student loans to big purchases,

developing a budget, and learning about saving. Making well-informed decisions at this time in your life can help you

achieve financial success and avoid expensive mistakes.

Stage 2: Wealth Accumulation

Accumulating wealth takes discipline and strategic investments. During your 30’s, next mile stones may include buying

your first home and/or saving for your children’s college education. Helping you reach your goals is more than just

relying on stocks and bonds. It is about understanding what matters most to you and prioritizing your investments. No

one can predict the future, but we can at least prepare ourselves financially.

Stage 3: Wealth Growth & Management

From your 40’s to Retirement, strategic investment and risk management is imperative. This is the critical period, to

assess where you are, correct past mistakes, and ensure that your retirement savings will be able to last you the rest of

your life. Many people spend more time planning their next big purchase than they do focusing on their financial health.

This could spell financial ruin when you’re ready to retire if your assets won’t support your current lifestyle.

Stage 4: Wealth Preservation

You’ve finally made it, retirement is here. Now you must shift to taking distributions and ensuring that the assets you

have accumulated last. You may be scared because you’ve spent your whole life working and saving.

Items to address include:

- What are your intentions for your assets – Do you intend to leave an inheritance or spend them down?

- What should your budget be based on current assets? Determine how much money can be withdrawn to

ensure your assets outlast your longevity. - Ensure your investments are structured in a manner to minimize the effect of market downturns.

A big fear many people have is running out of money or being a burden to their family. Now it’s time to revise your plan.

When you meet with Haven Wealth Group, our advisors will listen to your objectives and assess your financial situation.

Our goal is to help ensure that your wealth is preserved and help you achieve all of your financial goals!